In both cases, the compensation should be reported on your Form W-2. Or if you sell the shares one year or less from the "exercise date," which is when you purchase the stock, that is also considered a disqualifying disposition.  When you sell the stock two years or less from the offering date, known as the "grant date," the transaction is a disqualifying disposition. Now, if you sell the shares before they meet the criteria for favorable capital gains treatment, the sales are considered "disqualifying dispositions," and you may end up paying taxes on part of the proceeds of the sale at your ordinary income tax rate, which could be as high as 37% in 2021. No compensation is reported to you on your Form W-2, so you do not have to pay taxes on the transaction as ordinary income at your regular tax rate. Sales that meet these one- and two-year time limits are called "qualifying dispositions," because they qualify for favorable tax treatment. This is the most favorable tax treatment because long-term capital gains recognized in 2021 are taxed at a maximum 23.8% (or 0 if you're in the 10% or 15% income tax brackets) compared to ordinary income tax rates which may be as high as 37% in 2021. (Your profit is the difference between the bargain price you pay for the stock, and the market price that you sell it for.) If you can wait at least a year and a day after you purchase the stocks, and at least two years after you were granted the option to sell the stocks (as described in item 5 above), any profit on the sale is treated as a long-term capital gain, so it is taxed at a lower rate than your regular income. The time at which you sell determines how the proceeds are taxed. The first and last are the most favorable. Sell shares at least one year and a day after you purchased them, and at least two years since the original grant date.Įach transaction has different tax implications. Sell shares at least one year and a day after you purchased them, but less than two years since your original grant date.

When you sell the stock two years or less from the offering date, known as the "grant date," the transaction is a disqualifying disposition. Now, if you sell the shares before they meet the criteria for favorable capital gains treatment, the sales are considered "disqualifying dispositions," and you may end up paying taxes on part of the proceeds of the sale at your ordinary income tax rate, which could be as high as 37% in 2021. No compensation is reported to you on your Form W-2, so you do not have to pay taxes on the transaction as ordinary income at your regular tax rate. Sales that meet these one- and two-year time limits are called "qualifying dispositions," because they qualify for favorable tax treatment. This is the most favorable tax treatment because long-term capital gains recognized in 2021 are taxed at a maximum 23.8% (or 0 if you're in the 10% or 15% income tax brackets) compared to ordinary income tax rates which may be as high as 37% in 2021. (Your profit is the difference between the bargain price you pay for the stock, and the market price that you sell it for.) If you can wait at least a year and a day after you purchase the stocks, and at least two years after you were granted the option to sell the stocks (as described in item 5 above), any profit on the sale is treated as a long-term capital gain, so it is taxed at a lower rate than your regular income. The time at which you sell determines how the proceeds are taxed. The first and last are the most favorable. Sell shares at least one year and a day after you purchased them, and at least two years since the original grant date.Įach transaction has different tax implications. Sell shares at least one year and a day after you purchased them, but less than two years since your original grant date.  Exercise your option to purchase the shares and sell them after less than 12 months, but during the following calendar year. Exercise your option to purchase the shares, then sell them any time within the same year. Exercise your option to purchase the shares and hold them. Incentive Stock Option transactions fall into five possible categories, each of which may get taxed a little differently. With Non-qualified Stock Options, you must report the price break as taxable compensation in the year you exercise your options, and it's taxed at your regular income tax rate, which in 2021 can range from 10% to 37%. There is a catch with Incentive Stock Options, however: you do have to report that bargain element as taxable compensation for Alternative Minimum Tax (AMT) purposes in the year you exercise the options (unless you sell the stock in the same year). The price break between the grant price you pay and the fair market value on the day you exercise the options to buy the stock is known as the bargain element. With ISOs, your taxes depend on the dates of the transactions (that is, when you exercise the options to buy the stock and when you sell the stock). And, depending on how long you own the stock, that income could be taxed at capital gain rates ranging from 0% to 23.8% (for sales in 2021)-typically a lot lower than your regular income tax rate.

Exercise your option to purchase the shares and sell them after less than 12 months, but during the following calendar year. Exercise your option to purchase the shares, then sell them any time within the same year. Exercise your option to purchase the shares and hold them. Incentive Stock Option transactions fall into five possible categories, each of which may get taxed a little differently. With Non-qualified Stock Options, you must report the price break as taxable compensation in the year you exercise your options, and it's taxed at your regular income tax rate, which in 2021 can range from 10% to 37%. There is a catch with Incentive Stock Options, however: you do have to report that bargain element as taxable compensation for Alternative Minimum Tax (AMT) purposes in the year you exercise the options (unless you sell the stock in the same year). The price break between the grant price you pay and the fair market value on the day you exercise the options to buy the stock is known as the bargain element. With ISOs, your taxes depend on the dates of the transactions (that is, when you exercise the options to buy the stock and when you sell the stock). And, depending on how long you own the stock, that income could be taxed at capital gain rates ranging from 0% to 23.8% (for sales in 2021)-typically a lot lower than your regular income tax rate.

You report the taxable income only when you sell the stock.

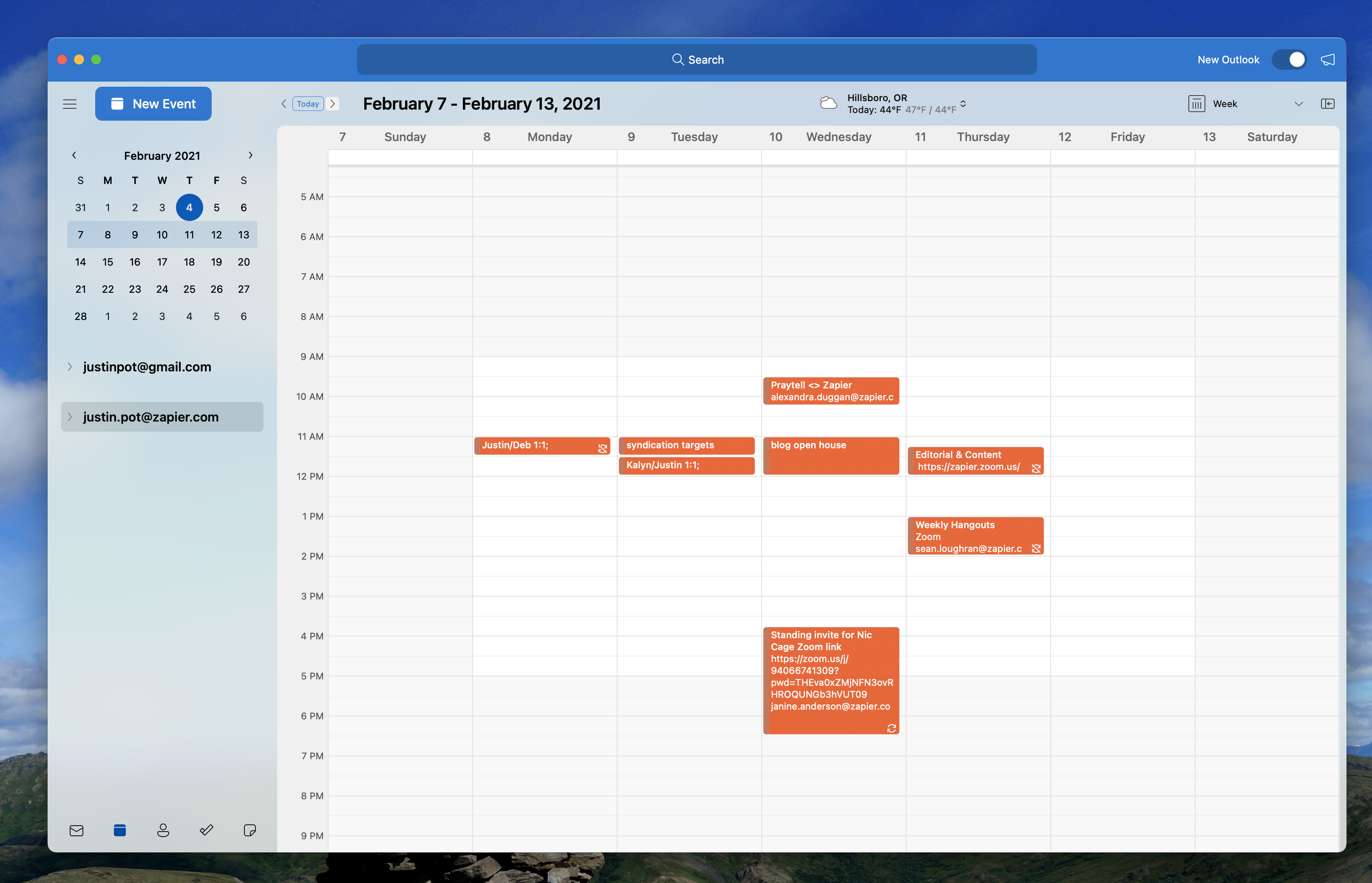

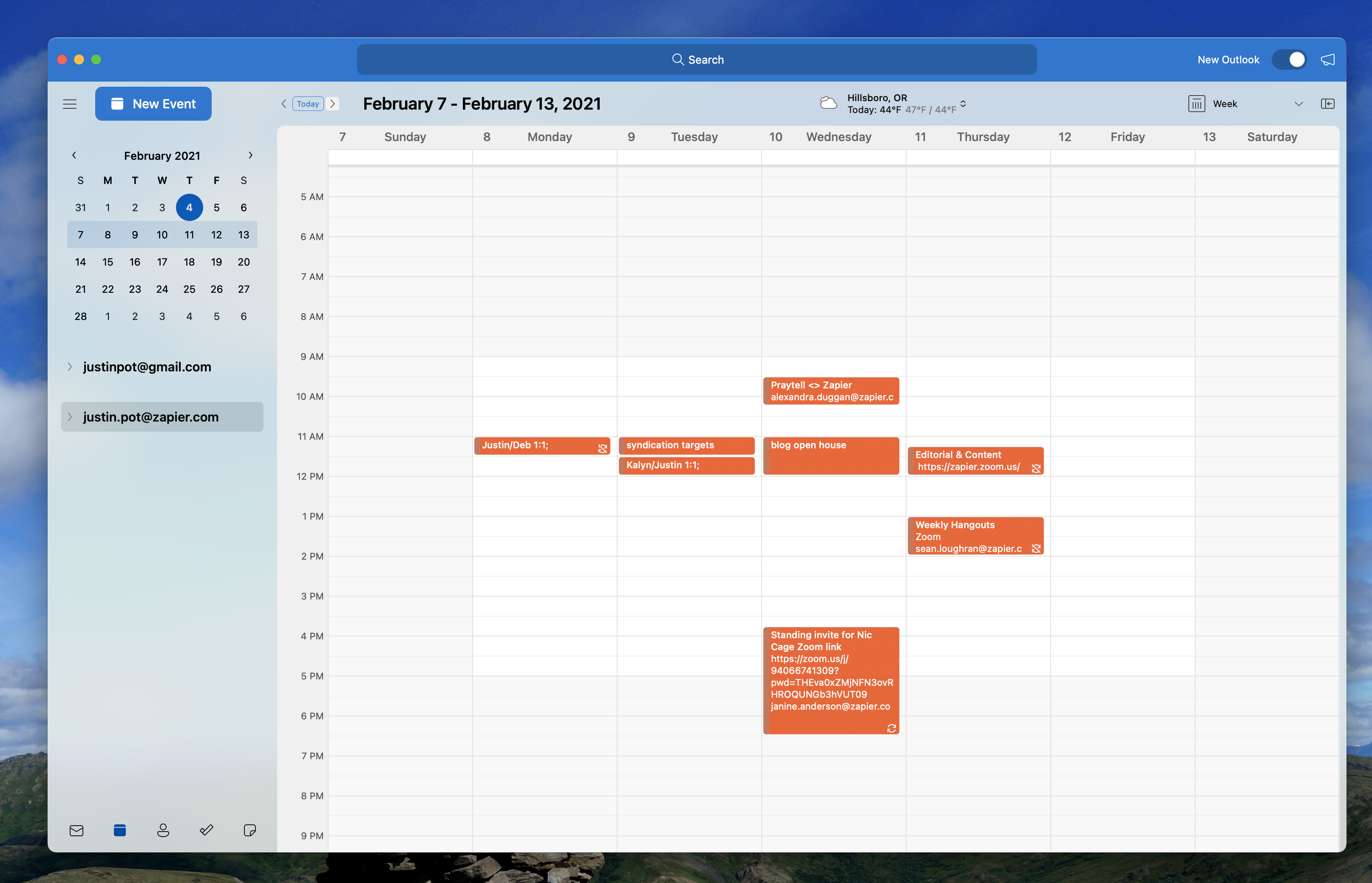

#$20 calendar app for mac 2017 iso

The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option. When you exercise Incentive Stock Options, you buy the stock at a pre-established price, which could be well below actual market value. Why are Incentive Stock Options more favorable tax-wise? The type of options should be clearly identified in the agreement.

If you are not sure, take a look at your option agreement or ask your employer. If you have been granted stock options, make sure you know which type of options you received. In most cases, Incentive Stock Options provide more favorable tax treatment than Non-qualified Stock Options. There are two types of stock options-Incentive Stock Options (ISOs) and Non-qualified Stock Options (NSOs)-and they are treated very differently for tax purposes. We'll help you understand ISOs and fill you in on important timetables that affect your tax liability so you can optimize the value of your ISOs.Ī stock option grants you the right to purchase a certain number of shares of stock at an established price. While ISOs can offer a valuable opportunity to participate in your company's growth and profits, there are tax implications you should be aware of. Some employers use Incentive Stock Options (ISOs) as a way to attract and retain employees.

0 kommentar(er)

0 kommentar(er)